Courses

-

Ethics (2024)

This course covers selected ethical principles as promulgated in the latest revision of Circular 230 and other applicable IRS guidance.

$99

-

Solar on a Rental and Tax Credit Sales

Can clients installing solar on their rental properties claim a tax credit? Yes: this webinar covers all IRS forms that must be filed and how the general business credit and passive activity credit limitations affect the ability to claim the credit.

$99

-

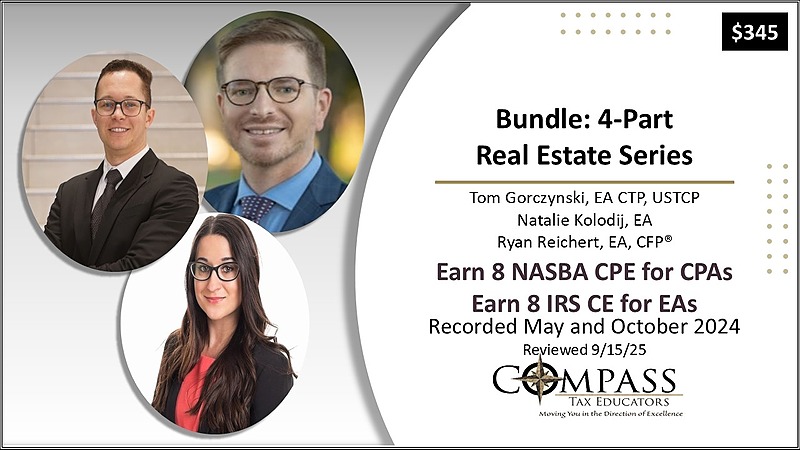

Bundle: 4-Part Real Estate Series

4 CoursesTom, Natalie, and Ryan each teach one class in this series, and Tom & Natalie team up to teach the Common Problems class together. Earn up to 8 CPE/CE with this real estate bundle!

$345

-

§1031 Exchange: A Practical Guide

Excel file included! Go step-by-step through the §1031 exchange process and proper completion of the required forms to report the exchange and determine its tax outcomes. You can quickly provide clients with accurate advice about planned exchanges.

$99

-

Refund Statute of Limitations

The refund statute of limitations is complex and often misunderstood. This webinar explains how to determine if a claim is timely, how much can be refunded in a timely claim, and the actions that can toll the refund statute.

$49

-

Penalty and Interest Accruals

With the dramatic increase in IRS interest rates from 3% to 8% over the last two years, understanding how the IRS imposes interest on unpaid balances can help tax professionals mitigate interest accruals for clients. Related penalties also discussed.

$99